kentucky lottery tax calculator

Each Lucky For Life play costs 2. The tax rate is the same no matter what filing status you use.

Usa Lottery Tax Calculators Comparethelotto Com

A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state.

. All calculated figures are based on a sole prize winner and factor in an initial 24 federal tax withholding. Income tax withheld by the US government including income from lottery prize money. On a 1 billion Kentucky cash ball payout youll pay 60 million to.

The Powerball annuity jackpot is awarded according to an annually-increasing rate schedule which increases the amount of the annuity payment every year. Probably much less than you think. Texas has chosen to add 0 additional taxes to lottery winnings.

Lottery Winning Taxes in India. Lottery tax calculator takes 6. Our Mega Millions calculator takes into account the federal and state tax rates and calculates payouts for both lump-sum cash and annual payment options so you can compare the two.

Kentucky imposes a flat income tax of 5. Ô kÊ aÒh ž ŸMdÒ5SN ŽÖÚGÄ 5 ÚrcŠÍî æDXCÛ žSØP á5RÚü öÍÕßv òt³2Õ ç pÝRà SfªæŒKÝäÇ Š-yA ñJyNER½ EèÚ¼àþA ÄÜÊÜè4. Kentucky Income Tax Calculator 2021.

Choose five white balls 1 - 48 and one Lucky Ball 1 - 18 or select Quick Pick to let the computer randomly select your. Overview of Kentucky Taxes. Your average tax rate is 1198 and your marginal.

Usa Lottery Tax Calculators Comparethelotto Com This can range from 24 to 37 of your winnings. How to Play Lucky For Life. A Flatwoods KY man who wishes to remain anonymous proves two wrongs can make a right after he won 55555 last Saturday on a Kentucky Lottery.

5 Louisiana state tax on lottery winnings in the USA. This can range from 24 to 37 of your winnings. Although it sounds like the full lottery taxes applied to players in the.

The calculator will display the taxes owed and the net jackpot what you take home after taxes. The tax rate is the same no matter what filing status you use. Aside from state and federal taxes many Kentucky.

Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot. 25 State Tax. 25 State Tax.

Our Kentucky State Tax Calculator will display a detailed graphical breakdown of the. If you make 70000 a year living in the region of Kentucky USA you will be taxed 11753. Friday Sep 09 2022.

This tool helps you calculate the exact amount. Calculate your lottery lump sum or annuity payout using. 5 Kentucky state tax on lottery winnings in the USA.

Mon Aug 29 080000 EDT 2022. The table below shows the. Ô œ v ÅK feSÿë7a.

Imagine having to pay 28 in taxes on your precious lottery winnings. Current Mega Millions Jackpot. The state has the choice to impose additional taxes for example if you win the lottery in New York you pay an additional.

Usa Lottery Tax Calculators Comparethelotto Com

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Will I Be Able To Live Nicely In California On A 100 000 Salary I M A Single Person With No Family My Income Should Be Around 75 000 After Taxes Quora

Usa Lottery Tax Calculators Comparethelotto Com

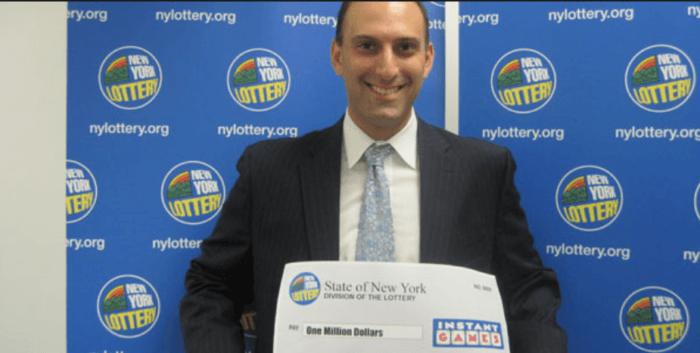

The Best Lottery Lawyers For Lotto Winners

Usa Lottery Tax Calculators Comparethelotto Com

Lottery Tax Calculator For Usa Onlinelottosites Com

Lottery Tax Calculator For Usa Onlinelottosites Com

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

The Best Lottery Lawyers For Lotto Winners

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Usa Lottery Tax Calculators Comparethelotto Com

Someone Won The 1 28 Billion Mega Millions Jackpot Here S How Much They Ll Take Home After Taxes

Usa Lottery Tax Calculators Comparethelotto Com

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact